Difference between revisions of "Future Swap"

(added charts link) |

Anantasesa (talk | contribs) m (→Background: grammar) |

||

| (One intermediate revision by one other user not shown) | |||

| Line 2: | Line 2: | ||

===Background=== | ===Background=== | ||

| − | after the introduction of | + | after the introduction of stock tokens, they were traded with a premium. The prices on the DEX were higher than the prices from the oracle. To fight this premium (but also a possible discount) the future swaps were introduced with DFIP-2203-A. |

https://github.com/DeFiCh/dfips/issues/127 | https://github.com/DeFiCh/dfips/issues/127 | ||

| − | This swap is executed once a week (every 7*2880 blocks). You can buy for + 5% of the oracle price or sell for -5% of the oracle price, even if the Price is | + | This swap is executed once a week (every 7*2880 blocks). You can buy for + 5% of the oracle price or sell for -5% of the oracle price, even if the Price is higher/lower than that 5%. Buy or sell means swapping to/from DUSD. |

===Scheduling=== | ===Scheduling=== | ||

On defiscan.live you can find a countdown to the next future swap block via the link | On defiscan.live you can find a countdown to the next future swap block via the link | ||

| Line 18: | Line 18: | ||

https://dstocks-defichain.web.app/ | https://dstocks-defichain.web.app/ | ||

| − | On defichain | + | On defichain analytics you can also follow the premium over time in a chart |

https://www.defichain-analytics.com/vaultsLoans?entry=premium | https://www.defichain-analytics.com/vaultsLoans?entry=premium | ||

===Strategy=== | ===Strategy=== | ||

| − | With this measure the price of the dTokens can be | + | With this measure the price of the dTokens can be held in a +-5% corridor. In case of a higher premium or discount it can get arbitraged. For the case of a premium the following trade can be done |

*Mint a dToken using a vault (take a loan) | *Mint a dToken using a vault (take a loan) | ||

| − | *The collateralization | + | *The collateralization ratio gets calculated using the oracle price (real price without premium) |

*Sell the minted dToken on the DEX (swap to DUSD) | *Sell the minted dToken on the DEX (swap to DUSD) | ||

| − | *Because of the premium you get | + | *Because of the premium, you get extra DUSD |

| − | *Do a future swap using the received DUSD to buy the dToken back paying the oracle price (cheaper | + | *Do a future swap using the received DUSD to buy the dToken back paying the oracle price (cheaper because it's without premium) |

| − | *When the future | + | *When the future Swap gets executed you will receive more dToken than you minted |

| − | *The loan (minted dToken) can be | + | *The loan (minted dToken) can be paid back and the additional dToken will stay in the wallet as a profit |

===Future Swap in the Light Wallet=== | ===Future Swap in the Light Wallet=== | ||

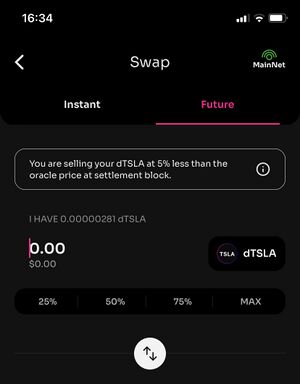

In the Light Wallet select the desired pool in the DEX tab. In the Swap menu you can switch from an instant swap to the future swap.[[File:LightWalletFutureSwap.jpg|thumb|Future Swap im light wallet]] | In the Light Wallet select the desired pool in the DEX tab. In the Swap menu you can switch from an instant swap to the future swap.[[File:LightWalletFutureSwap.jpg|thumb|Future Swap im light wallet]] | ||

Latest revision as of 17:00, 23 October 2022

Future Swap

Background

after the introduction of stock tokens, they were traded with a premium. The prices on the DEX were higher than the prices from the oracle. To fight this premium (but also a possible discount) the future swaps were introduced with DFIP-2203-A.

https://github.com/DeFiCh/dfips/issues/127

This swap is executed once a week (every 7*2880 blocks). You can buy for + 5% of the oracle price or sell for -5% of the oracle price, even if the Price is higher/lower than that 5%. Buy or sell means swapping to/from DUSD.

Scheduling

On defiscan.live you can find a countdown to the next future swap block via the link

https://defiscan.live/blocks/countdown/NextFutureSwap

In the desktop wallet you can check the next future swap block using the command getfutureswapblock

To quickly check for the current premium of the stock tokens you can use the dStocks Quickcheck page at

https://dstocks-defichain.web.app/

On defichain analytics you can also follow the premium over time in a chart

https://www.defichain-analytics.com/vaultsLoans?entry=premium

Strategy

With this measure the price of the dTokens can be held in a +-5% corridor. In case of a higher premium or discount it can get arbitraged. For the case of a premium the following trade can be done

- Mint a dToken using a vault (take a loan)

- The collateralization ratio gets calculated using the oracle price (real price without premium)

- Sell the minted dToken on the DEX (swap to DUSD)

- Because of the premium, you get extra DUSD

- Do a future swap using the received DUSD to buy the dToken back paying the oracle price (cheaper because it's without premium)

- When the future Swap gets executed you will receive more dToken than you minted

- The loan (minted dToken) can be paid back and the additional dToken will stay in the wallet as a profit

Future Swap in the Light Wallet

In the Light Wallet select the desired pool in the DEX tab. In the Swap menu you can switch from an instant swap to the future swap.

Future Swap in the Desktop Wallet

In the console view of the desktop wallet you can use the command futureswap.

Syntax:

futureswap "address" "amount" ( "destination" [{"txid":"hex","vout":n},...] )

For example to swap 500 DUSD to Netflix token:

futureswap "dVvPfdjhfdjhfjd32dPWZoNYno7uBUn1KyU" "500@DUSD" dNFLX)

Using the command getpendingfutureswaps you can check which future swaps have alread been set for a given address.

getpendingfutureswaps "address"