Investing & Trading with Decentralized Loans and Assets on DeFiChain

We explain DeFiChain - Investing & Trading with Decentralized Loans and Assets on DeFiChain

Part 1: Long and short positions with stock token

| With decentralized loans and assets on DeFiChain, you can invest in different assets betting on increasing (long) or decreasing (short) prices. We will explain 3 different ways of investing. |

Long position - Neutral DFI

| Investment thesis

The future price of an asset will be higher than it is today. DeFiChain procedure

Goal in the future

Profit: Remarks

Example With a DFI price of $2.50 you sell 280 DFI, and receive 700 dUSD. You buy 1 TSLA for those 700 dUSD and hold it. After some time the TSLA price rises to 1000 dUSD and the DFI price to $4.00. Selling TSLA for dUSD gives you 1000 dUSD and you make 300 dUSD profit. Remark

→ The best case for this investment: The asset price increases |

Short position - Long DFI

| Investment thesis

The future price of an asset will be lower than it is today. DeFiChain procedure

Goal in the future

Profit: Remarks

Example With a DFI price of $2.50 you put 280 DFI into a decentralized loan = $700. For the value of $700 you get 0.5 TSLA (200% collateralization and TLSA price of $700). You sell this 0.5 TSLA on DEX and get 350 dUSD. After one year the TSLA price decreased to $500 and the DFI price increased to $4.00. Now you buy back the 0.5 TSLA for 250 dUSD and 0.01 TSLA for 5 dUSD (interest). With 0.51 TLSA you can now close your loan and make 95 dUSD profit. You also receive back your DFI, which are now worth $1120 and you make an additional profit of $ 420. Your DFI long position was the right choice. → The best case for this investment: The Asset price decreases and DFI price increases! |

Long position - Long DFI (leverage)

| Investment thesis

The future price of an asset and DFI will be higher than it is today. DeFiChain procedure

Goal in the future

Profit: Remarks

Example With a DFI price of $2.50 you put 280 DFI into a decentralized loan. For the value of $700 you get 350 dUSD (200% collateralization). You use this dUSD to buy 0.5 TSLA on DEX. After one year TSLA price goes up to $1000 and DFI price up to $4.00. Now you sell the 0.5 TSLA for 500 dUSD. With 357 dUSD (350 dUSD plus 7 dUSD fee) you can close your loan and made 143 dUSD profit. You also receive back your DFI, which are now $1120 worth and made an additional profit of $ 420. Your DFI long position was right. → The best case for this investment: Asset price increases and DFI price increases |

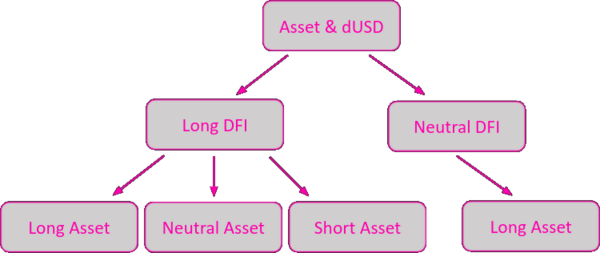

Part 2: Liquidity mining

| With decentralized loans and assets on DeFiChain you can generate cashflow with liquidity mining. In this case you have four different ways depening on your investment strategy. |

Liquidity Mining – Neutral DFI / Asset long

Investment thesis

DeFiChain procedure

Goal in the future

Profit: Remarks

Example Swap 560 DFI to 700 dUSD and 1 TSLA, which has an overall value of $1400 (DFI price $2.50). Put both of them into LM with a DEX price of 700 dUSD/TSLA.

Remove liquidity after some time with increased price to 1000 TSLA.

Removing liquidity and swapping the 0.836 TSLA abd 836 dUSD into USD will result in an overall amount of Additional to your Liquidity Mining rewards, you got $272 profit from price movement of TSLA, this is the profit from asset long position you made. Remark If in the same time frame DFI goes up to $4.00, you will only get 478 DFI for your USD position. → The best case for this investment: The price of the asset increases |

Liquidity Mining – Long DFI / Asset neutral

Investment thesis

DeFiChain procedure

Goal in the future

Profit: Remarks

Example Generate 1 TSLA and 700 dUSD with 1,120 DFI (200% collateralization and DFI price $2.50). Put them into Liquidity Mining with a DEX price of 700 dUSD/TSLA.

Remove liquidity after some time with increased price to 1000 TSLA.

Removing liquidity will give you 0.164 less TSLA and 136 more dUSD. Swapping the 136 dUSD will result in an overall amount of 0.028 TSLA are missing to close the loan and must be bought from reward income.

→ The best case for this investment: Pool ratio remains unchanged and DFI increases. |

Liquidity Mining – Long DFI / Asset long

Investment thesis

DeFiChain procedure

Goal in the future

Profit: Remarks

Example Generate 1,400 dUSD with 1,120 DFI (200% collateralization and DFI pricen $2.5). Swap 700 dUSD for 1 TSLA. Put both of them into Liquidity Mining with a DEX price of 700 dUSD/TSLA.

Remove liquidity after some time with increased price to 1000 TSLA.

Removing liquidity and swapping the 0.836 TSLA into dUSD will result in an overall amount of You got 272 additional dUSD from price movement of TSLA, which are not needed for closing the loan. This is the additional profit from asset long position. If in the same time frame DFI goes up to $4.00, you will make additional profit of $1,680 to your Liquidity Mining rewards with your DFI long position. → The best case for this investment: The price of the asset and DFI increase. |

Liquidity Mining – Long DFI / Asset short

Investment thesis

DeFiChain procedure

Goal in the future

Profit: Remarks

Example Generate 2 TSLA with 1,120 DFI (200% collateralization and DFI pricen $2.5). Swap 1 TSLA for 700 dUSD. Put both of them into Liquidity Mining with a DEX price of 700 dUSD/TSLA.

Remove liquidity after some time with decreased price to 500 dUSD/TSLA.

Removing liquidity and swapping the 590 dUSD into TSLA will result in an overall TSLA amount of You got 0.36 additional TSLA from price movement of TSLA, which are not needed for closing the loan. This is the additional profit from asset short position. If in the same time frame DFI goes up to $4.00, you will make additional to your Liquidity Mining rewards a profit of $1,680 with your DFI long position. → The best case for this investment: The price of the asset goes down and DFI goes up. |

Part 3: Leverage of DFI with decentralized loans

| With decentralized loans and assets on DeFiChain you can leverage your DFI position. Basically, there are two different ways to use the leverage effect. |

Leverage of DFI – DFI Multiple long

| Investment thesis

The future price of DFI will be higher than it is today and you want to participate with more then lineare increase. DeFiChain procedure

Goal in the future

Profit (double long):

Remarks

Example (maximum leverage)

After one year DFI price goes up to $4.00 dUSD.

Overall profit: $450 + $275 + $183.34 = $725/$908.34 (double/triple long) Result without leverage: 450dUSD → The best case for this investment: the DFI price increases (and never drops to liquididation level). |

Leverage of DFI – DFI Multiple long/Asset short

| Investment thesis

The future price of DFI will be higher than it is today and you want to participate with more then lineare increase. At the same time the asset price decreases. DeFiChain procedure

Goal in the future

Profit (double long):

Remarks (additional to first scenario)

→ more possible profit → but higher risk to loose collateral (DFI price decreases and asset token increases)

Example (maximum leverage)

After one year the DFI price increases to $4.00 dUSD and the TSLA price decrease to $500:

Overall profit: $450 + $237.5 + $300 = $987.5 Result without leverage: $450dUSD → Best case for this investment: DFI price goes up and asset price goes down |

Leverage of DFI – Liquidation risk

| Liquidation risk

If the value of your collateral drops below the defined loan level, you have to increase it. Otherwise your loan will be auctioned off. Using a combination of DFI and some stable coins like USDC or USDT as a collateral can reduce the risk, because half of the holdings are stable against US-Dollar. For a better understanding and comparabillity, we will introduce some figures

To avoid liquidation the following inequality must always be fullfilled: With this the relative part of your collateral representing loan level is: Now, the question of how much your collateral ratio can drop, can be derived: Example With a DFI price of $2.50 you put 100 DFI (investment = $250) into a decentralized loan with a collateralization level of 200% and generate an asset token $100 worth. (For constant asset value), your collateral must stay above $200 to avoid liquidation. → Possible price reduction befor liquidation: Depending on the planned collateral ratio, you can decide which loan level fits your willingness to take risk. Have in mind, that the lower loan collateralization levels will have higher interest.

If your collateral is only DFI and the assets price remains constant, the table directly reflects the allowed DFI price change. |

Leverage of DFI – Level of Leverage

| Level of Leverage

The leverage depends on the number of iteratively created loans and converges to a fix ratio. This depends on the used collateral ratio. Example

With a DFI price of $2.50 you buy 400 DFI (investment $1000) and put them into a decentralized loan. You get 500 dUSD (200% collateralization) and buy 200 DFI → Leverage factor: 1.5 Table with leverage factors for different collateral ratio:

→ For effective leveraging you need a low collateral ratio, which will be near the liquidation level - higher risk! |

Part 4: Arbitrage trading of dUSD – DFI pool

Arbitrage trading of dUSD – DFI pool – Crypto arbitrage

| Arbitrage trading on current Crypto-DEX

Scenario 1: DFI is cheaper on DEX

Scenario 2: DFI is more expensive on DEX

→ External resources allow perfect arbitrage |

Arbitrage trading of dUSD – DFI pool – dUSD arbitrage

| Arbitrage trading on decentralized assets DEX

Scenario 1: DFI is cheaper on DEX

The decentralized assets will be a closed ecosystem on DeFiChain. No other opportunities to buy or sell DFI for arbitrage. Everything must be done via loans or DFI. Closing arbitrage position only in the reverse way of opening it. → No external or other resource for arbitrage |

Arbitrage trading of dUSD – DFI pool – Overall control

|

The operator of the loan schemes can influence the buy or sell pressure in the dUSD-DFI pool by changing the interest rates. |